Difference between revisions of "Taxes"

m |

|||

| Line 1: | Line 1: | ||

| − | + | Here are some handy guides to help you fill out those pesky tax forms. Unfortunately, only the Canadian and American sections have been fully fleshed out. Please help us out by adding your country's specific information while ensuring that everything is up-to-date. | |

| + | |||

| + | ==The Income Tax Withholding Slip== | ||

| + | |||

| + | You may have recently received a slip that looks like this. It's your income tax withholding slip, or "kyuyo-shotoku-gensen-choshu-hyo" (給与所得源泉徴収票). This slip will be used when you file your taxes in your respective country. You should keep a copy of it for your records. | ||

| + | |||

| + | Any ways, what does it mean? Check out the statement key below the picture. This information was originally posted on [http://www.nic-nagoya.or.jp/en/e/archives/352| Nagoya International Center's] website. For a more detailed explanation of how your income tax withholding was calculated, please visit their website! | ||

| + | |||

| + | [[File:Income_Tax.jpg]] | ||

| + | |||

| + | *Income Tax Withholding Statement Key | ||

| + | '''A)''' Total salary earned during the year<br> | ||

| + | '''B)''' Income after employment income deduction<br> | ||

| + | '''C)''' Total fixed-rate exemptions<br> | ||

| + | '''D)''' Income tax withheld at source<br> | ||

| + | '''E)''' Marital status and spousal exemption<br> | ||

| + | '''F)''' Number of dependents in each category; specific dependents (16 – 22 year old relatives), elderly dependents (70 and over), others (includes children)<br> | ||

| + | '''G)''' Fixed Rate Exemptions (social insurance, life insurance, accident / injury insurance, mortgage, spouse’s income, personal pension, long-term accident insurance)<br> | ||

| + | '''H)''' Employer’s name and address<br> | ||

==Home Country Taxes== | ==Home Country Taxes== | ||

Revision as of 12:14, 29 January 2014

Here are some handy guides to help you fill out those pesky tax forms. Unfortunately, only the Canadian and American sections have been fully fleshed out. Please help us out by adding your country's specific information while ensuring that everything is up-to-date.

The Income Tax Withholding Slip

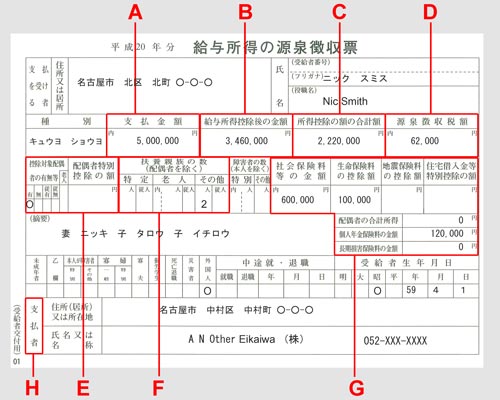

You may have recently received a slip that looks like this. It's your income tax withholding slip, or "kyuyo-shotoku-gensen-choshu-hyo" (給与所得源泉徴収票). This slip will be used when you file your taxes in your respective country. You should keep a copy of it for your records.

Any ways, what does it mean? Check out the statement key below the picture. This information was originally posted on Nagoya International Center's website. For a more detailed explanation of how your income tax withholding was calculated, please visit their website!

- Income Tax Withholding Statement Key

A) Total salary earned during the year

B) Income after employment income deduction

C) Total fixed-rate exemptions

D) Income tax withheld at source

E) Marital status and spousal exemption

F) Number of dependents in each category; specific dependents (16 – 22 year old relatives), elderly dependents (70 and over), others (includes children)

G) Fixed Rate Exemptions (social insurance, life insurance, accident / injury insurance, mortgage, spouse’s income, personal pension, long-term accident insurance)

H) Employer’s name and address

Home Country Taxes

| Life in Mie | |

|---|---|

| Services & Living | Appliances • ATMs • Driving • Food • Finances • Hair • Internet • Mail • Medical • Phones • Shopping • Vegan • Wildlife |

| Rec. & Entertainment | Amusement Parks • Arcades • Festivals • Movies • Nightlife • Onsen • Outdoors • Restaurants • Sports |

| Official Procedures | Re-entry • Visa Extension • Visa Change • IDP • Driver's License • License Renewal • Taxes • Pension |

| Transportation | Air • Bus • Ferry • Night Bus • Train • Travel Agencies |

| Mie Guidebook |

|---|

| Top Page • Cities & Towns • Life in Mie • FAQ • Travel Guides • Learning • Teaching • JET Program • Wiki Help |